4 Reasons Why OEMs Should Finance Tooling

If you’ve ever watched a home improvement or renovation reality show, you may notice that it’s the exception rather than the rule that the builds meet the budget. Here’s how the story goes – the clients and the builders do a walkthrough of the home, then develop a plan and budget to make the necessary upgrades, renovations and improvements.

But inevitably, as the project goes on, something unexpected happens or is discovered. These unexpected variables result in the project going over budget, or modifications are made to the original plan that cause some projects to go incomplete as there isn’t enough money to do it all.

The same issue can impact an OEM that designs and develops new products. The roadmap has been set for the products you plan to launch, but as the development process starts, unexpected changes occur, priorities change, or unforeseen business requirements shift the budget to other areas. Your department still has a goal and objectives to achieve, shareholders to satisfy, and the need to bring products to market, but a lack of available capital can limit or delay the entry of products into the marketplace.

Cost and Complexity in Product Development

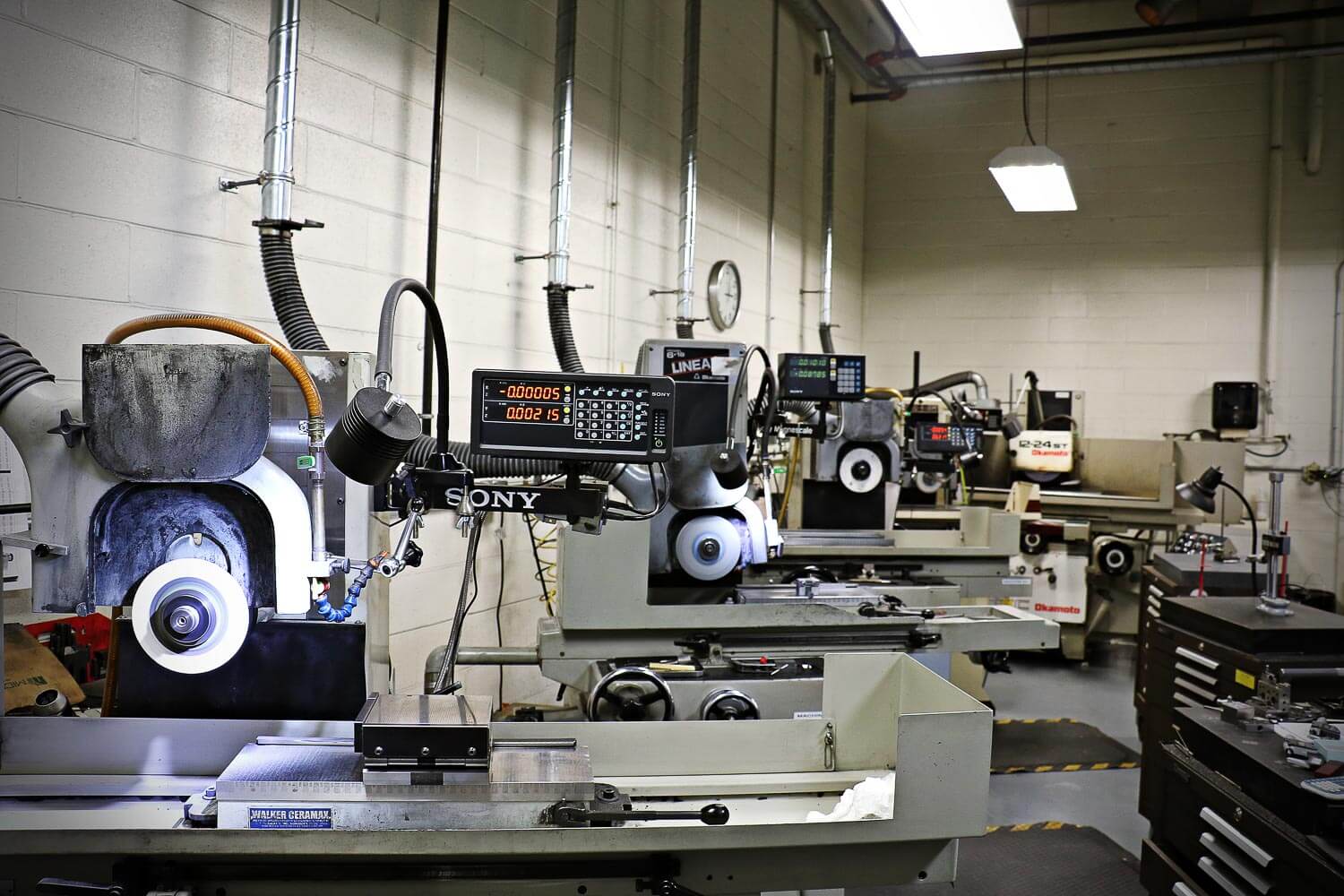

To get the benefit of low piece price, part-to-part repeatability, and output volume of production injection molding, OEMs must invest in injection mold tooling. The cost of tooling can be expensive compared to the price of the injection-molded part, ranging from $15,000 to well over $250,000 for dedicated tools to produce parts that are in the $0.20-$0.60 per piece range. While the part price is far more competitive than machining the parts from plastic bar or plate stock, it may take companies months or years to pay back the initial investment.

Tooling is a significant expense and adds a level of complexity to new programs. One way to remove this complexity from your new project is through access to financing.

Here are four core ways that a partner in tooling financing can benefit your OEM business:

1) Stretch CapEx Budget

Capital expenditures (CapEx) can carry both benefits and risks to your organization. Investing in CapEx can improve your efficiencies, allow you to gain a competitive advantage, and help you bring a product to market to increase your profitability. But if the expenditure doesn’t yield the necessary results, those monies could have been allocated elsewhere.

Financing your tooling non-recurring engineering (NRE) instead of buying the assets outright frees up working capital that can be used up for other purposes. This provides your organization with a consistent and predictable level of financing throughout the year, which helps with CapEx budgeting and cash flow.

2) Strong Cash Flow

Good cash flow management yields many benefits to every organization. The inflow and outflow of profits are crucial to a business and ensuring that those liquid assets are stable or increasing is always a primary focus. Positive cash flow allows companies to continue to reinvest in the business, pay employees and shareholders, pay expenses, and provide a buffer against future financial challenges.

By financing your tools, the outflow of cash is minimized in a given fiscal year and stretches that profit to benefit your organization. This can be especially critical for smaller companies and startups, slowing the cash burn to help companies be more competitive as they introduce new products into the marketplace.

3) Product Roadmap Flexibility

In a typical OEM, each department is required to present an annual budget to finance and management for the next fiscal year. For companies that are developing product on an ongoing basis, this would include the CapEx required to design, develop, prototype, tool up, and launch to production the molded parts necessary to produce the product.

The right financing option will vary given your business’s specific budgetary requirements. Work with a partner through your planning process to determine the right budgetary option, whether it’s full NRE paid outright to launch the product or financing the CapEx. Having this kind of flexibility can allow an OEM to launch more projects within a fiscal year since the expenditures can be spread out over 3 to 5 years.

4) Reduce the Barrier to Entry for Life-Enhancing Products

Through innovation, groundbreaking products are often introduced by small, creative, fast-moving companies eager to get their products to market to address issues identified with the established products in the marketplace.

Healthcare OEMs have an opportunity to improve patient outcomes, and in order to do so, need to get production intent or production-validated products into trials to verify positive clinical results and improvements. Tool financing can reduce the barrier to entry of lifesaving products by spreading costs over time.

Financing Is Only One Creative Solution for Product Development

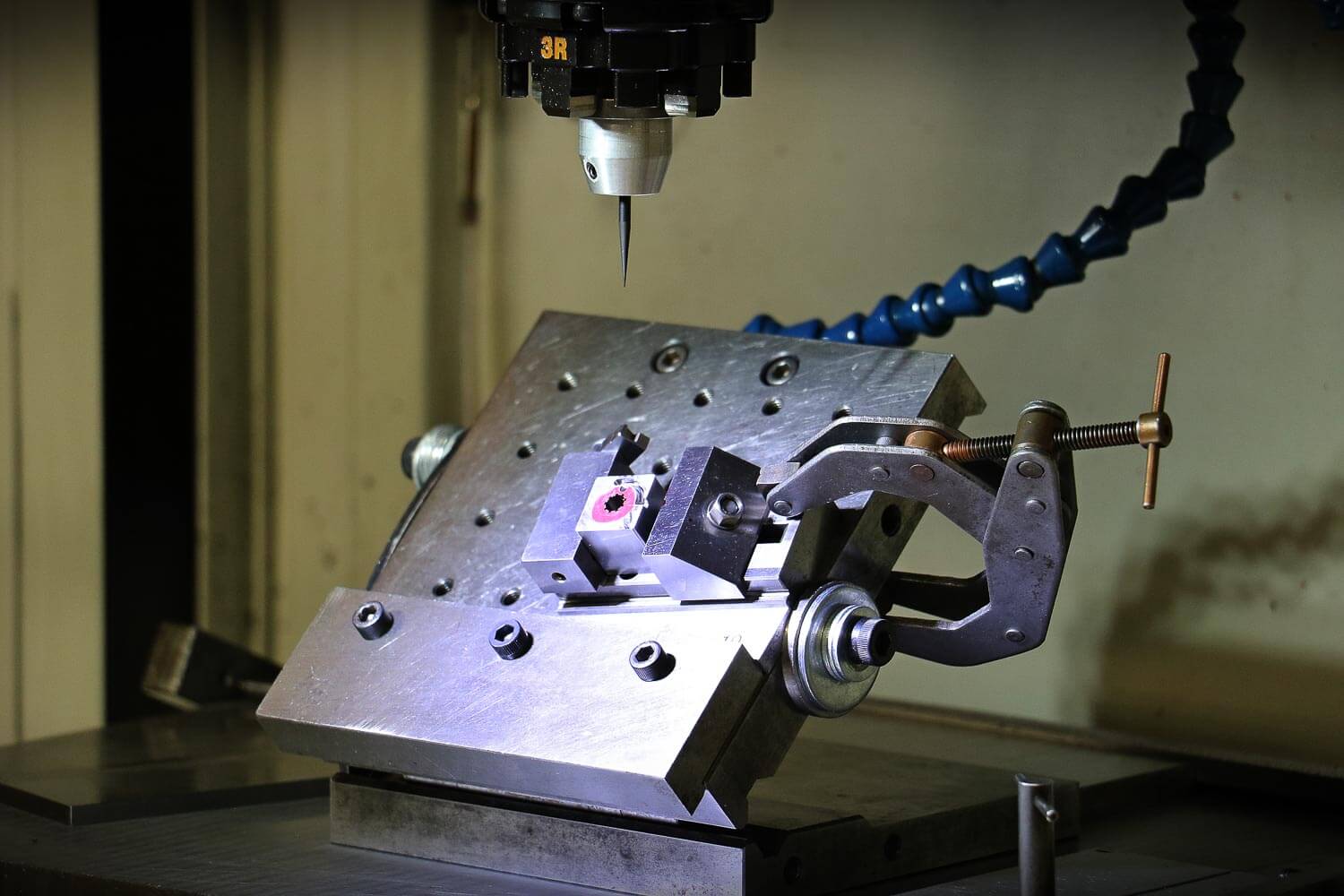

Forum Plastics is committed to finding creative ways to assist customers with product development, going beyond engineering, design for manufacturing (DFM), and material recommendations. In fact, Forum Plastics is currently the only company in the United States currently offering financing to customers for tooling.

Partner with Forum Plastics to increase your market penetration of products, improve your ROE and ROI, and minimize the impact of tooling cost on your project budgets. By engaging with Forum on our tooling programs, you also gain access to our engineering, purchasing, scheduling, production, quality and metrology departments, putting the entire breadth of our manufacturing experience at your disposal.

To learn more about Forum’s tool financing program, visit us online or contact Keston Thompson at (203) 754-0777 or kthompson@forummolding.com

Stay Connected

Sign up to get updates from Forum